In this article, EIOPA experts analyze the relation between the gender pension gap and the gender pay gap, labour market conditions, as well as how social and behavioural factors influence financial planning and investment decisions for men and women and how they subsequently reinforce the gender pension gap.

Labour market and the gender pay gap

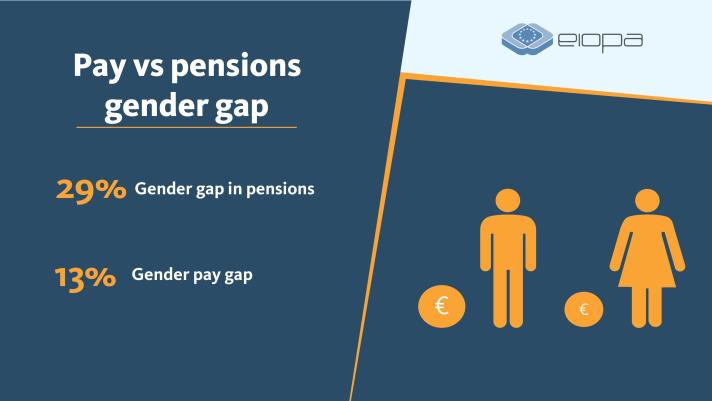

The gender gap in pensions in the EU is substantially higher at 29% on average compared to the gender pay gap at 13% on average.

While women often work in lower paid jobs, they are also more likely to have worked part-time and to have had longer career breaks.

Since pension benefits are often earnings-related, these differences in career profiles between men and women can lead to large gender disparities in pension payments.

Our analysis does not identify high differences in hourly wages to be systematically associated with high gender pension gap. However, our results clearly show that the gender pension gap is higher in countries where high percentage of women work part-time.

Social and behavioural considerations

The analysis shows that women have different investment patterns and behaviour than men, which may add further obstacles preventing them to build the same income for retirement as men do.

Women tend to be significantly more risk averse then men, which in turn has implications, especially when it comes to investment decisions. Indeed, women are likely to have a more conservative approach to building or choosing their investment portfolios, they tend to show avoidance of gambling or speculation and finally, tend to have a more short-term vision when prioritising their needs, putting less emphasis on long-term goals such as retirement income.

Many behavioural and social aspects, including risk aversion, income uncertainty, and short-termism in financial allocation, direct women in opting out of private pensions savings, which are mostly voluntary. Low participation in private pensions is problematic, as private pensions are increasingly seen as a way to lower the pressure from the public system and to contribute to an adequate level of retirement income for future pensioners.

Addressing the gender pension gap

The gender pension gap is not a simple issue to tackle, as it has many underlying factors.

The article gives insights and examples on how to adapt the design of the pension system and ways to increment societal and investment behavioural changes.

When developing pension policies aimed at successfully mitigating these gaps, they need to be specifically targeted on a particular issue at a time: financial education for women, marketing campaigns for women, financial advice, portfolio management, participation in different pension systems, increasing contributions to the pension systems for women, ensuring an adequate income level and strategy diversification, tackling with stereotyping and repositioning social views on gender roles etc.

Conclusions

The findings of the article emphasize the need to strengthen women careers to further reduce the gender pension gap. This can be done by providing children related benefits, adequate childcare support or adapting the options available in the pension scheme design to let partners take over some of the burden of pension responsibilities.

One aspect that connects to both the pension gender gap, as well as the general pension gap in an increasingly aging population, is the need to mitigate the so called “motherhood penalty”.

Increasing financial literacy and improving financial advice and marketing may also help women address their behavioural inclinations and social constraints in order to diminish the gender investment gap and the corresponding private pensions gender gap.

Finally, other measures such as promoting women participation through auto-enrolment or introducing gender neutral discount factors for pension payments may further contribute to reducing the gender pension gap.

The thematic article was published as an Annex in EIOPA’s Financial Stability Report, June 2024 edition.

Details

- Publication date

- 26 June 2024